Gusto aids accountants in helping clients apply for PPP loans

Gusto, a provider of payroll, HR, benefits and insurance services for small businesses, has been partnering with accountants to help them secure loans for their clients under the Small Business Administration’s Payroll Protection Program so they can weather the economic crisis brought on by the COVID-19 pandemic.

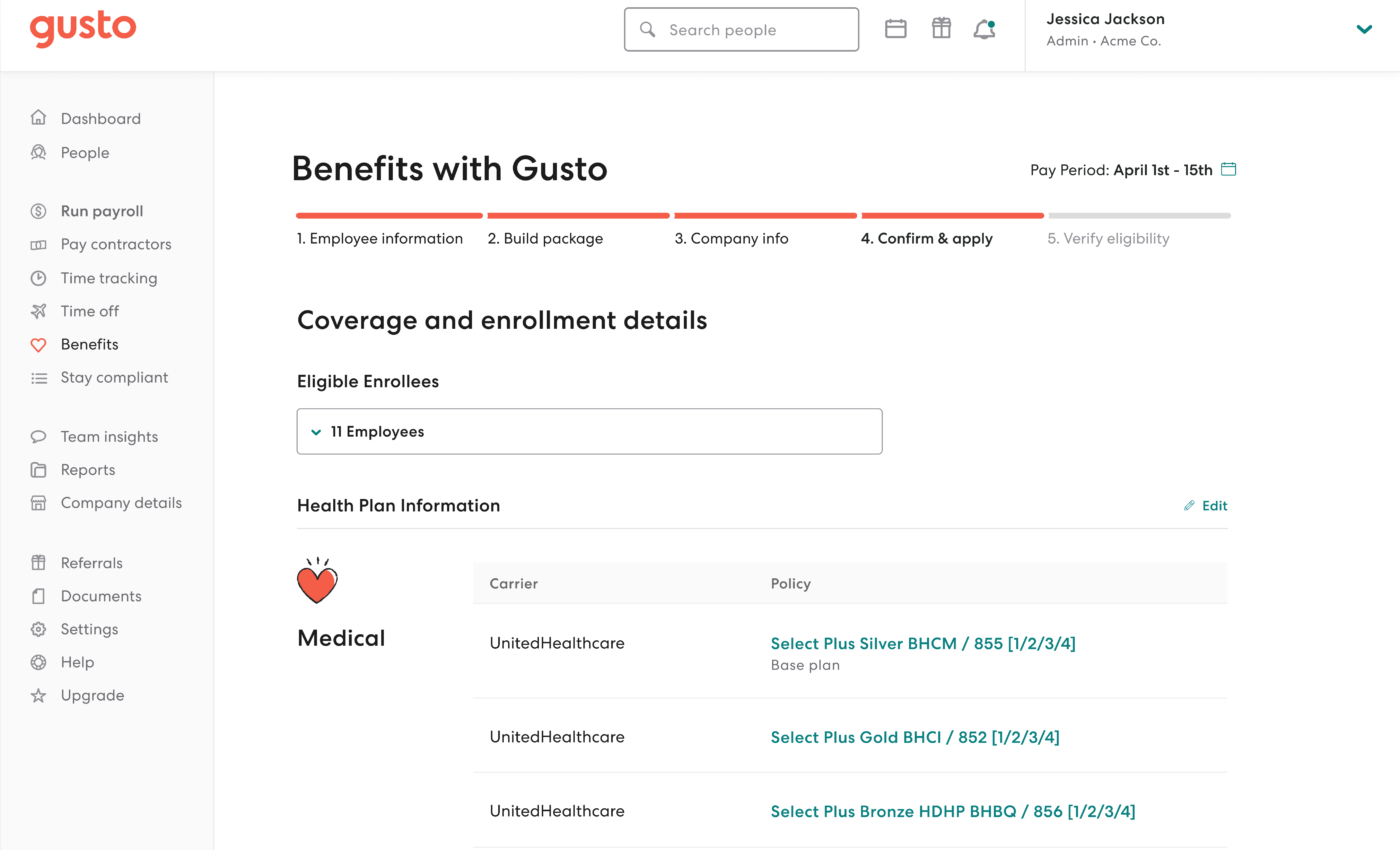

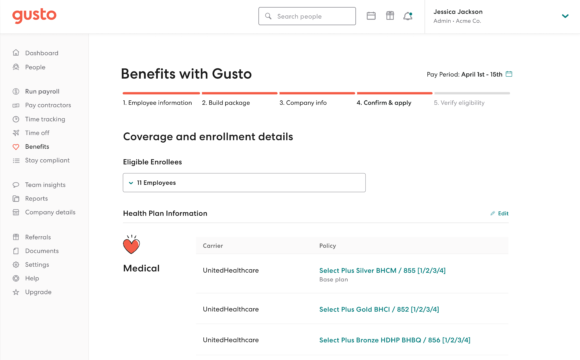

The company has been adding more than 40 features since the Payroll Protection Program was created as part of the CARES Act in response to the pandemic to help small businesses and accountants keep track of PPP applications. Those include a PPP application report that has been downloaded more than 80,000 times, along with a PPP Loan Forgiveness Tracker that customers are using to track the approximately $1.5 billion in approved PPP loans facilitated through the product.

“This is a major crisis,’ said Gusto co-founder Tomer London. “It’s a major health crisis, but it’s also a crisis for small businesses. We see our job is to be there and help them and to advocate for them. Not just help them through the software that we build and the services that we provide, but also being out there and doing advocacy and being out there with regulators in terms of how we can make the best impact possible to help small businesses survive.”

Gusto launched in 2012 under the name ZenPayroll and it has been concentrating this year on helping customers deal with the pandemic, especially after the CARES Act was approved a little over two months ago. A Social Security Tax Deferral opt-in feature takes advantage of another provision of the CARES Act to let customers defer the employer portion of their Social Security taxes for the rest of 2020 to be repaid in 2021 and 2022.

“In terms of the crisis response, we really changed our priorities and we are dedicating our company to focus on one thing, which is to be there for these small businesses and their accountants in this challenging time,” said London. “I work very closely with our engineering team, and the vast majority of the engineering team is now focused on this COVID response.”

Gusto recently launched Gusto Pro, a product specifically for accountants, and is part of an AICPA-led coalition that supports expedited small-business funding.

Will Lopez, head of Gusto’s accountant community, has been working with accountants who have been helping their clients secure much-needed loans. “From an accountant’s perspective, you realize that small businesses don’t sit on a lot of cash,” he said. “I think two is the average number of months that a small business has to absorb any kind of business impact, so when the economy shuts down for at least two months, which is what has happened, it puts a tremendous amount of pressure on that small-business owner to act quickly and try to push past the existential threat of shutting down.”

He has been seeing small and medium businesses working closely with accounting professionals to endure the pandemic. “There are statistics that say the small business survival rate is 40 percent higher when they’re working with and getting in front of an accounting professional,” said Lopez. “What we’re seeing in our partner community is that accountants are flexing their expertise far beyond accounting and taxes while working quickly and efficiently to help their clients get the funding they need, whether it’s federal funding or state funding or private resources. So accountants are stepping into their natural advising role during COVID-19, which is pretty amazing to watch.”

Mike Jesowshek, a Wisconsin CPA who operates a virtual firm called Jetrotax with accountants in his and other states, has used Gusto to help secure PPP loans for 55 percent of his small-business clients. Most of his clients are either attorneys, fitness studios or professional services firms. The PPP had a rocky rollout when it launched on April 3 with $349 billion in funding aimed at helping small businesses keep their doors open and retain their employees. Many small businesses had trouble accessing the loans or applying for them, and the funding quickly ran out as larger companies managed to get the loans with the help of their banks. Congress provided another $320 billion and the program resumed on April 27. However, the rules and eligibility and forgiveness criteria kept changing, prompting many businesses to take a wait-and-see attitude.

“In general the Paycheck Protection Program has just been a crazy circle,” said Jesowshek. “We got some initial guidance when it first came out back at the beginning of April, and since then things have been constantly changing. Getting the information out, informing clients and then saying, ‘Oh, gotta back up. Something changed on some of the information. More clarification came out.” Our clients at the beginning really struggled to get the PPP funding. It wasn’t until that second round of funding came through that most of our clients started to get funded. We did have a handful of clients get approved in that first line of funding, but most were not. Now at this point, most of our clients have gotten funding if they applied for it and haven’t had a problem. Now that things are starting to slow up, it seems like there’s a lot more availability to work with banks. Banks aren’t as backlogged as far as that goes. It has been quite a whirlwind just with the constantly changing items.”

Many small businesses remain concerned about the requirements for getting the loans forgiven, and the House passed legislation last week to make the terms more flexible. The Senate passed the bill on Wednesday night and sent it to President Trump for his signature.

Besides joining the AICPA coalition, Gusto recently partnered with the Opportunity Fund, a nonprofit microfinance organization, and the Community Reinvestment Fund USA, a nonprofit that helps people in economically disadvantaged communities. It has also partnered with Cross River Bank, and online lenders Fundera and Lendio to streamline the loan process.

The funding came just in the nick of time for one small business. Christine Schmidt, owner of the Yellow Owl Workshop in San Francisco, was able to secure a PPP loan through Cross River Bank. “I logged onto my bank account to pay bills, and there was all this money in there,” she said. “We cried and jumped up and down immediately. Honestly, we were hours away from laying off our whole staff. The PPP loan funding has cleared out this thick, anxious fog. I’m grateful now my biggest struggle is shifting between work and homeschooling my eight-year-old. Second graders and common core math are not respecting my creative process.”